One's portfolio should have a proper balance between risk-free investments, low-risk/low-return and high-risk/high-return investments. This balance will naturally change over time. As one ages and approaches the retirement age, the portfolio will move from high-risk towards low-risk.

In this regard, I intend to periodically(most likely on a quarterly basis) record my portfolio standing. This will help me out in several ways:

- Identify the risk-reward balance for the portfolio at a given point in time and modify it accordingly.

- Identify the portion of savings allocated to the different investment types and correct that allocation over time.

- Monitor the growth of the investments over time and restructure if needed.

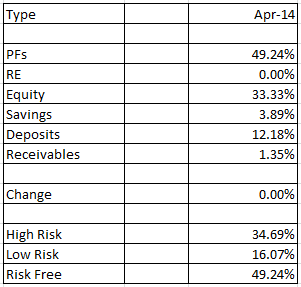

Figure 1: Asset allocation including Real Estate(RE) investment through loan

I purchased a flat at a very early stage of life(I'm nearly 24 years old) and this has skewed my portfolio heavily towards that investment. I have provided an asset allocation excluding the RE investment as well, but that's below. Let's take a look at this one first.

- The High Risk investment comprises of the Equity and Receivables(money lent to others) components.

- The Low Risk investment comprises of the balance in the Savings bank account as well as the Deposits(a few Recurring Deposits(RDs)).

- The Risk Free investment comprises of the RE and PF(PPF and EPF contributions) components.

- Change is currently recorded as 0. This value will get updated when the next period's analysis is done.

- Analysis - As is obvious, considering the age factor and the ability to bear risk, the High Risk component is much lower than it should be. I feel that it should at least have 60% allocation of total investments. The remaining 40% can be divided between Low Risk and Risk Free investments. That said, I don't think that may be possible(certainly not in the near future) due to the heavy contribution from RE.

Figure 2: Asset allocation excluding Real Estate(RE) investment

Now, let's take a look at the asset allocation if we exclude the RE investment.

- Analysis - The Low Risk and Risk Free components together account for about 65% of the total portfolio assets. This kind of a distribution is suitable for someone around the age of 50! In spite of removing RE from the calculation, the charts show that the portfolio is not designed as it should be.

- The low allocation in High Risk is not because I can't handle the risk, it's because the portfolio is not designed correctly. It requires restructuring to amplify potential returns(at the cost of increased risk, which I can bear).

- Since Equity is the only High Risk favourable investment(hate the idea of Receivables increasing) and the PF contribution is already quite high, every opportunity I get to deploy surplus funds should be two purposes - Savings(to meet Emergency Fund requirements, more on that here) and Equity(increasing potential returns). Another challenge is that, every month, a fixed amount from my income is earmarked for PF(EPF) by the company, so I'd have to trump that amount to alter the current portfolio allocation - no easy task considering the EMI I pay for the RE.

Figure 3: Equity Portfolio

Since Equity investment is a critical component of my future investments aimed towards obtaining a well-structured portfolio, I felt it would be a good idea to monitor the Equity Portfolio as well and tailor it to meet my requirements.

- The Defensives include SUNPHARMA and ITC.

- Risky bets includes FSL and GAYAPROJ.

- Growth includes HCLTECH, L&T and SBIN.

- NIFTY is the EOD index value (for Nifty) against which we will compare the portfolio. We will also record the equity net worth change over time.

- Newly Added funds refers to the funds added between the two periods that we compare the portfolio. Deployable funds refers to the funds that is earmarked for equity investment but is currently held in cash with the brokerage firm.

- Analysis - As I see it, Defensives allocation is quite high. Any funds that need to be deployed ahead should be put in Growth or Risky bets. I feel that not more than 20% of the portfolio should be held in Risky bets(I've often had ill luck with these). Besides if the Growth stocks net substantial returns, then there won't be a need to over-expose the portfolio to the Risky bets.

- Strictly speaking, I am a long-term investor and seldom do I attempt short-term trades to book quick profits. So I anticipate we'll see low returns in the near future, but over a period of time, the returns should be decent enough(if fortune favours me). However, that is for the future, let's just see how things move from here.

- I don't like to hold portfolios with a lot of stocks since they don't really help with risk reduction through diversification beyond a certain point. I am not saying I know what that magic number is, but I tend to draw the line at 6 to 8 stocks, considering that the absolute amounts I am investing are not very high. Guess I'll just have to learn with time and find this magic number out myself.

Well, it is obvious that this portfolio needs a lot of work! Until I started this exercise, I never imagined that my portfolio would be so biased towards Low-Risk investments. I probably knew it, but just didn't want to accept it. Charting the portfolio and writing this down definitely helped. I suggest everyone should maintain a track record of their investments to ensure that the portfolio is structured the way it is meant to be(or required to be) structured.

Do let me know your thoughts and suggestions.

No comments:

Post a Comment